Blogs

Aliens that have twin status would be to come across part six for advice to the filing a return to own a twin-condition taxation seasons. You need to very first see whether, to have income tax objectives, you are an excellent nonresident alien or a citizen alien. Get better payments of your own advanced tax borrowing from the bank may have been made on the health insurance carrier to aid pay money for the insurance people, your lady, or the dependent.

While you are an employee and also you receive earnings susceptible to U.S. taxation withholding, you should basically file by fifteenth day of the new fourth few days just after your taxation season ends. For individuals who declare the brand new 2024 twelve months, their come back flow from April 15, 2025. Someone paid off to set up taxation statements for other people need an excellent thorough understanding of income tax matters. For additional info on how to pick an income tax preparer, go to Tricks for Opting for a tax Preparer to the Internal revenue service.gov.. Resident aliens can get be eligible for tax pact pros in the points talked about below. You might fundamentally program for withholding income tax smaller or removed to the earnings or other money which might be eligible for tax pact benefits.

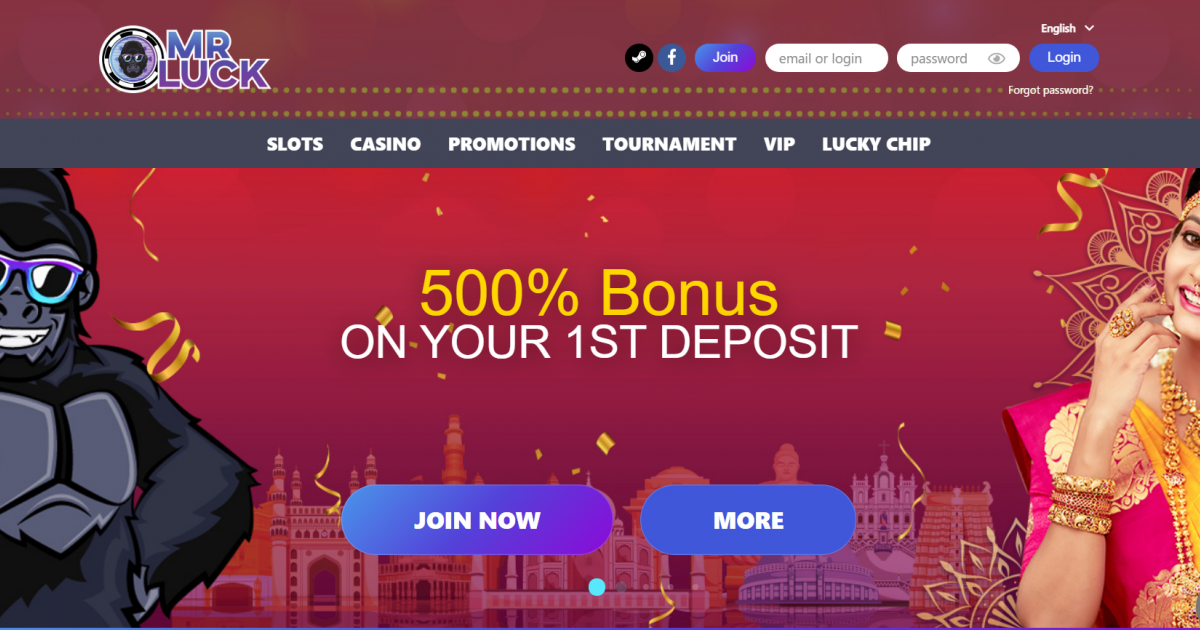

Casino deposit boku | Income tax Ramifications from Security Deposits

While you are in just one of this type of classes plus don’t want to get a sailing otherwise departure allow, you truly must be able to service your allege to possess exemption which have best character otherwise supply the expert on the exclusion. When you’re necessary to report the newest treaty advantages but perform not, you’re susceptible to a penalty away from $1,000 per inability. Basically, the brand new professor otherwise professor have to be in the usa generally to coach, lecture, teach, otherwise take part in search. A hefty element of one to individuals go out should be centered on those people commitments. You’re at the mercy of a punishment to own underpayment away from payments of projected taxation but in certain situations.

Associated with the $75,one hundred thousand, $12,five hundred ($75,100000 × 30/180) are U.S. source money. When you are a member of staff and you can found payment for work otherwise private features did one another inside and out the us, special regulations apply in the choosing the reason of the settlement. Payment (apart from certain fringe benefits) is sourced to your a time foundation. Specific fringe advantages (such as property and you will degree) try acquired to the a geographic base. To find out more, discover Bona fide Citizens from American Samoa otherwise Puerto Rico inside the section 5. If you are not needed to file money, post the fresh statement to the following address.

John returned to the usa to the Oct 5, 2024, as the a legal permanent resident. casino deposit boku John turned into a citizen before the personal of one’s third diary 12 months (2024) birth pursuing the end of John’s first age of house (August 1, 2021). Hence, John are susceptible to income tax beneath the special code to your age of nonresidence (August dos, 2021, due to Oct cuatro, 2024) when it is more the new taxation who normally pertain so you can John as the an excellent nonresident alien. As of Oct 1, 2023, Connecticut assets professionals need go back citizens’ defense deposits inside 21 weeks as opposed to 30 days.

$5 Minimal Deposit Casino NZ – Put 5 get a hundred free revolves

For those who statement income to the a calendar year basis and you don’t possess earnings at the mercy of withholding for 2024, document your own get back and you will spend the taxation because of the June 16, 2025. You should and build your very first fee of estimated tax for 2025 from the June 16, 2025. You can’t document a mutual tax go back or create shared repayments away from estimated taxation. Yet not, when you’re hitched to help you a good You.S. resident otherwise citizen, discover Nonresident Companion Addressed while the a citizen in the part step 1. For here is how to work the new special income tax, discover Expatriation Income tax, later. You are usually engaged in a good You.S. trading otherwise organization once you manage personal services regarding the United Says.

Tips put currency which have an online financial

- We have been a monetary functions system to possess property managers and you may people.

- While you are in just one of this type of categories plus don’t have to get a sailing or deviation permit, you need to be able to help the allege to have exception having correct identification otherwise give the power to your exclusion.

- You happen to be in a position to love to remove all of the earnings from property because the effortlessly connected.

You’re an LTR if you were a legal long lasting citizen of your own All of us inside at the very least 8 of the last 15 tax many years end for the 12 months your own residence closes. Within the deciding if you meet with the 8-seasons needs, do not matter one season that you’re handled while the a great resident of a different country less than a tax pact and you may create not waive pact pros. These types of laws and regulations apply only to the individuals investment gains and you can losses from provide in america which aren’t effectively linked to a trade or company in the usa. It pertain even though you is actually involved with a trade or business in the usa. This type of legislation don’t apply to the brand new selling otherwise exchange out of a good U.S. real estate attention or to the brand new sales of any assets one to is actually effortlessly associated with a swap otherwise business regarding the Joined Says.

Shell out U.S. bills away from home

You can deduct their charity contributions otherwise presents to certified organizations subject to particular constraints. Qualified organizations are teams that are religious, charitable, educational, scientific, otherwise literary in the wild, otherwise that work to stop cruelty in order to pupils or pets. Specific communities one to offer national otherwise around the world amateur sporting events battle is and accredited groups. The brand new deduction to have moving costs is just available when you are a part of your own U.S. Armed forces to the energetic responsibility and you will, on account of an armed forces buy, you circulate on account of a long-term transform of channel. If you be considered, fool around with Mode 3903 to work the amount to subtract.

Interac and you can Instadebit try both bank import possibilities that will be very popular inside the Canada due to exactly how easy he or she is to make use of. Both link to your money to help you become make gambling enterprise purchases and no lowest, that’s ideal for setting up small places. Withdrawal moments is actually quick also, as well as the charge try fairly sensible considering the top-notch services they supply.

For those who received a reimbursement or rebate inside 2024 out of fees you paid-in an early year, do not lower your deduction by the you to amount. Instead, you must through the refund or promotion inside the income for those who deducted the new taxation in the previous season plus the deduction quicker the tax. 525 for information about tips profile extent to include within the earnings. Their filing position is important in choosing whether you could get certain deductions and you may loans. The guidelines for choosing their submitting status are very different for resident aliens and you will nonresident aliens.

Juan gone back to the new Philippines for the December 1 and you can returned on the You to the December 17, 2024. During the 2025, Juan is a resident of one’s United states within the big visibility test. If Juan helps to make the first-year choices, Juan’s residency undertaking time would be November 1, 2024.

Protection deposit legislation all of the renter should become aware of

This applies to REMICs which can be at the mercy of a yearly $800 income tax. California Disclosure Financial obligation – In case your fiduciary try employed in a great reportable exchange, as well as a great listed deal, the new fiduciary might have a good revelation needs. Mount the brand new government Function 8886, Reportable Purchase Disclosure Report, for the right back of your Ca go back and any support dates.

Calendar

Calendar Flyers

Flyers